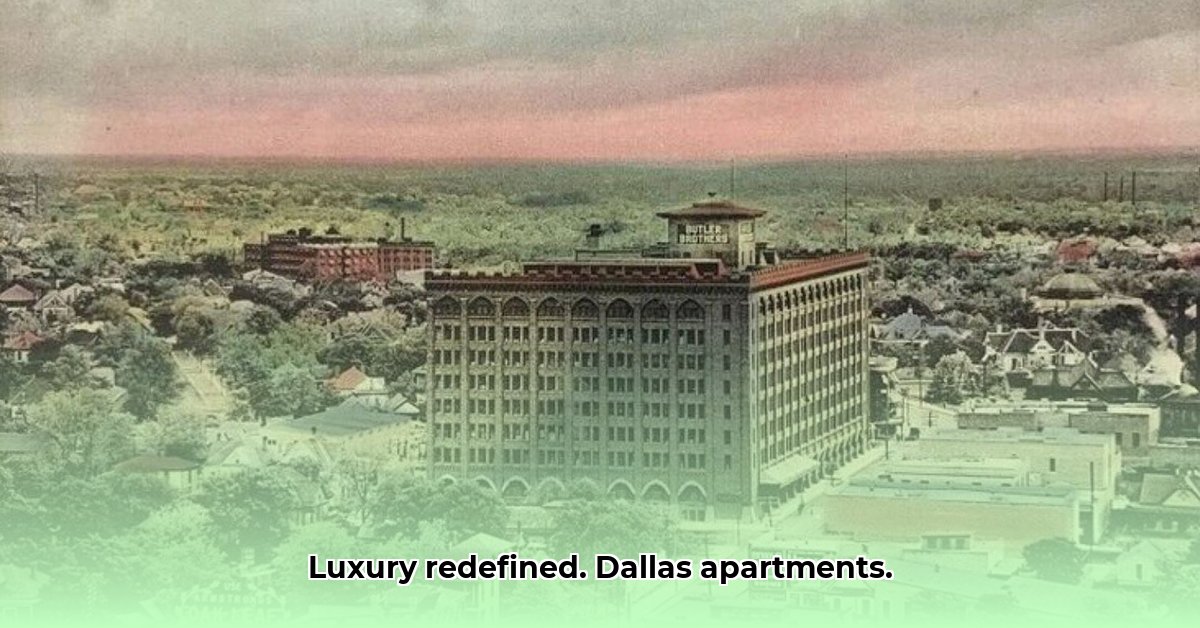

The Butler Brothers Building in Dallas stands as a testament to successful urban redevelopment, transforming a historic structure into a thriving luxury apartment complex. This case study analyzes its revitalization, highlighting key success factors, challenges encountered, and actionable insights for future projects. The project's success hinges on strategic location, premium amenities, and a careful balance between preserving historical integrity and incorporating modern luxury.

A Prime Location: The Foundation of Success

The Butler Brothers Building benefits from an unparalleled location in the heart of Dallas. Its proximity to the Dallas World Aquarium, the Museum of Art, and the American Airlines Center provides residents with immediate access to cultural attractions and entertainment. Furthermore, convenient access to major highways (I-30, 75, and 35E) ensures effortless city navigation. This strategic positioning significantly enhances the building's appeal to a wide target demographic, including young professionals, families, and students, contributing to high occupancy rates. Isn't prime location a crucial factor in the success of any luxury development? The building’s location is undeniably a significant driver of its success, confirming the importance of site selection in real estate development.

Resort-Style Amenities: Elevating the Living Experience

Beyond its location, the Butler Brothers Building distinguishes itself through a comprehensive suite of resort-style amenities. These amenities extend far beyond the typical apartment complex offerings, significantly impacting resident satisfaction and attracting high-end renters. Residents enjoy access to a sparkling pool, a state-of-the-art fitness center (complete with yoga and dance studios), game rooms featuring the latest digital entertainment and karaoke facilities, and even an art studio. The inclusion of valet parking and 24/7 surveillance adds an extra layer of convenience and security, enhancing the overall living experience. This commitment to providing luxurious amenities is a key differentiator in the competitive Dallas luxury apartment market. How many other complexes offer such a comprehensive and diverse range of services within the same building?

Addressing Data Discrepancies and Research Gaps

While the success of the Butler Brothers Building is evident, certain data points require further clarification. Discrepancies exist regarding the exact number of residential units, with sources reporting figures ranging from 237 to 274. This discrepancy may stem from differing methodologies, possibly including or excluding hotel units within the complex. Similarly, the precise construction date of the original building (often cited as 1910) requires verification through archival research and official records. A thorough investigation is needed to determine the extent of original structure preservation during the renovation. Finally, the missing data on pricing strategy – specifically, a comparison to similar luxury apartments in the downtown core – hinders a complete financial evaluation of the project's success. This lack of comprehensive financial information is a significant limitation for any in-depth analysis of this case study.

Pricing Strategy and Market Analysis: An Opportunity for Deeper Insight

Understanding the Butler Brothers Building's pricing strategy relative to comparable properties is crucial for a comprehensive analysis. The current lack of transparent data on rental rates prevents us from quantifying its success solely on financial performance. Future research should explore how rental rates are determined, comparing them with similar complexes in the downtown area. Furthermore, identifying the specific income levels and lifestyle preferences of the target demographic will reveal further context for its success. The presence of two Marriott hotels within the complex certainly plays a part in the pricing and occupancy rates, which needs to be carefully considered in any future research.

Actionable Insights and a Roadmap for Continued Success

To ensure the long-term success of the Butler Brothers Building, several key stakeholders must take proactive steps. The following table outlines short-term (0-1 year) and long-term (3-5 years) actions for different stakeholders:

| Stakeholder | Short-Term Actions (0-1 year) | Long-Term Actions (3-5 years) |

|---|---|---|

| Building Management | Optimize occupancy through targeted marketing; gather resident feedback. | Explore revenue diversification (e.g., event space rentals, strategic partnerships). |

| Investors | Closely monitor occupancy rates and rental income; assess market trends. | Consider expansion opportunities or investment in similar projects in high-growth areas. |

| Marketing Team | Ensure accuracy of unit counts across all marketing materials; showcase unique features. | Refine marketing strategies to better target specific demographics and preferences. |

| Residents | Provide regular feedback on amenities and services; suggest improvements. | Foster a community through resident events. |

Unanswered Questions and Future Research

Further investigation is needed to fully understand and assess the long-term success of the Butler Brothers Building. A thorough comparative analysis with other luxury apartments in the Downtown Dallas area is needed. A comprehensive financial analysis, encompassing detailed income and expense data, will be equally vital. Finally, a large-scale resident satisfaction survey will provide invaluable insights into the resident experience and identify potential areas for improvement. Addressing these knowledge gaps is critical for a complete evaluation of the project's continued efficacy.

The Butler Brothers Building redevelopment serves as a captivating case study, highlighting how a historic landmark can be transformed into a thriving, modern residential community. However, the story is incomplete without addressing the research gaps identified in this analysis. Further investigation will undoubtedly reveal even more profound insights into the nuances of luxury apartment development in Dallas.